Should You Ignore Averages in Dental Practice Valuation?

The pros and cons of averages in dental practice valuations.

contact us Work with Us

The pros and cons of averages in dental practice valuations.

contact us Work with UsWhen you’re purchasing a dental practice, don’t fall into the “average practice value” trap. This trap has to do with a number that’s both simple and helpful … right up until it isn’t. Let me explain.

After analyzing over a thousand dental practice sales nationwide, I can tell you the average sales price — as a percentage of collections — for any major type of dental practice. A general dentistry practice will sell for an average of about 76.8% of annual collections. Oral surgery and pediatric dentistry practices see a similar percentage, with orthodontics coming in higher (84.1%) and periodontics a bit lower (73.1%).

Why it’s helpful: This number tells you very clearly whether a practice you’re considering purchasing falls above or below the average sales price.

Why it’s a trap: This number doesn’t tell you anything about why or whether the practice in question should be priced above or below the average.

In fact, for the most part, you can safely ignore the average sales price.

If anything, it’s like a signpost at the beginning of a hike; it tells you something about the path you’re on, but won’t help you much once you start walking. Knowing the nationwide average gives you a little bit of info up front, but it won’t tell you anything about the practice you’re looking to buy.

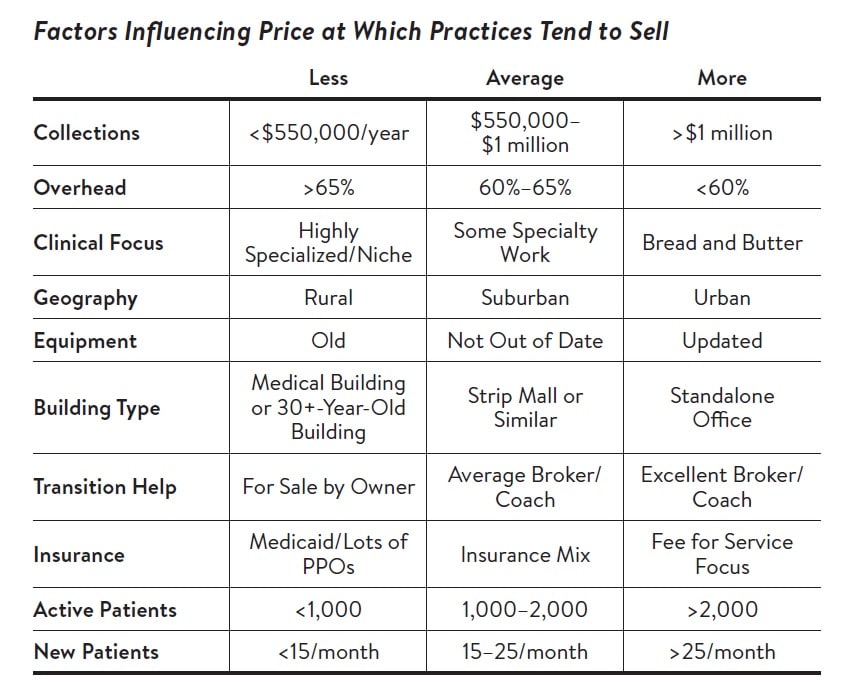

Instead, you’ll find some genuinely helpful numbers and other factors as you dig into the due diligence on a specific practice. What is this practice’s overhead? How new is the equipment? What is its clinical focus? Its geography? Its active patient count?

As you peek under the hood of a practice for sale, these other factors will start to tell you a story. It may be that you find out that you’re getting a great deal on an amazing practice that’s listed above the average sales price. Or perhaps you realize that the selling doctor has (understandably) overestimated the worth of the practice he’s spent the last several decades building.

Whatever the story is, it has little to nothing to do with those national averages, and you can and should leave that number behind early on in the buying process. Don’t use it to judge a specific practice, and above all, don’t use it during negotiations with a seller.

I once had to part ways with a client who was an overaggressive negotiator, looking to purchase an established, slightly-above-average practice, which was priced to match. This buyer wanted — no, needed — to get the sales price below the average because, in his mind, that would mean he’s getting a “deal.” So he negotiated everything he could think of, trying to get that price down. In reality, the buyer would have had a good deal had he purchased the practice at the listed price. Instead, the purchase never happened.

Use the average sales price number as a starting point as you look around for potential practices to purchase. But once you zero in on a specific candidate, forget about averages and start looking at the practice itself. The story that emerges will give context that a national average number can never provide.

Read More:

No, DSOs are NOT Taking Over Dentistry – Here’s Why

Dental Practice Ad Budgets Tell a Story You Need to Know | Being a Good Dental Practice Owner

Why You Should Buy a Dental Practice Before Your Student Loans are Paid Off

Listen to this podcast to understand how to quantitatively analyze a practice for sale.