How Much Is a Dental Practice Worth?

Whether you’re a buyer or seller, you’ll need to accurately assess a practice’s worth. We have some data that will help.

contact us Work with Us

Whether you’re a buyer or seller, you’ll need to accurately assess a practice’s worth. We have some data that will help.

contact us Work with UsWhen selling a dental practice, you want to price it in the Goldilocks zone. Too high, and you might not get any takers. Too low, and you’re giving money away. Just right, and you get the most from your practice.

If you’re buying a practice, you need to assess how much it’s worth to you, rather than blindly accepting the seller’s asking price—or counteroffering $200K over “just because.”

When talking about the right price, don’t expect to nail it down to the nearest dollar. As long as you get it within a range of “just right values,” you’re doing great.

Most buyers are fine to pay a fair price for a good practice, they just don’t want to get ripped off. As a seller, you’ll want solid logic and data to back up your pricing decision.

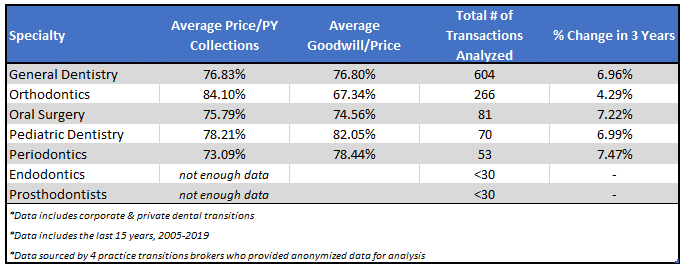

Your practice is worth EXACTLY 76.83% of prior year’s collections. Just kidding. That’s an average, and it’s for general dentistry. Your practice could be worth more or less than that, depending on location, specialization, overhead, and a whole lot of other factors.

I arrived at the above figure by collecting and analyzing some data from my clients. Let’s get into the numbers.

I’ve collected data from 160+ transitions I’ve been involved in to date and combined that data with anonymized data from four brokers in different geographies around the U.S. who were kind enough to collaborate to get a starting point to answer the question:

“How much is my dental practice worth?”

Take the following data as just that: data. It’s not the gospel truth to valuing your dental practice, but it is a useful lens.

Here are some key takeaways from the data I compiled:

A few notes about the data:

Ultimately, a dental practice’s worth to a buyer is all about its net profitability.

When I help buyers evaluate the price of a practice, I continually emphasize that wealth in dentistry comes from the ownership of an income stream, NOT from buying and selling dental practices.

Sure, no one wants to overpay for a practice. But far more important than the purchase price is the practice’s after-expenses cashflow.

For example, two practices that collect exactly $1 million each year will probably have an asking price close to each other. But if overhead is 60% in one practice, and 70% in the other, one owner is taking home $100,000 a year more than the other.

A buyer who, presumably, will own a practice for decades should be much more willing to pay top dollar for a practice with demonstrated low overhead and high cash flow.

A buyer looking at a good practice with solid fundamentals and profits, in a city they want to live in, and with a good patient base and staff who haggles over $10,000 on the purchase price is often penny-wise and pound-foolish. There’s nothing wrong with asking politely for $10,000 off the asking price, but destroying the effective transfer of goodwill between a buyer and seller is almost never worth the battle.

If you’re a buyer, be in the ballpark but don’t get too myopic about price.

The average amount of goodwill in a transaction is important for both buyer and seller. But it’s really, really important for the seller, as they probably pay a much higher tax rate on any amount not allocated to goodwill.

Goodwill seems to be hovering in the 75-80% range of total transaction price with the obvious exception of orthodontics where buyers are effectively paying for contracts receivable in addition to the underlying value of the business, which lowers the overall goodwill percentage.

Without question, practice ownership continues to be the most lucrative career option in dentistry. Current practice owners can feel some confidence knowing that the trendline supports higher average practice values compared to prior year collections.

Buyers need to be aware that, while prices are going up, both the number of dental lenders and the amount they are willing to lend is increasing. Banks don’t lend money unless they are confident they’ll get paid back. This is an indication that the path of practice ownership is both safe and lucrative.

Yes, buyers need to also be aware that the data indicate an inherent bias in the pricing structure to favor collections OVER profitability. Practically, this means that the good, profitable practices are going to sell quicker and be marginally harder to find. That just means that buyers need to have a stronger network made up mostly of other dentists, though using brokers is still the second-best way to find a practice to buy.

If you need help analyzing the price of a practice you’re considering, reach out anytime.

Listen to this podcast to understand how to quantitatively analyze a practice for sale.

Whether you’re trying to find a practice or have already closed on one, we provide expert guidance for every aspect of the deal. Click any of the links below to learn more.

It all starts with finding the perfect dental practice for you.