Asset Allocation in Dental Practice Acquisition Taxes

Things to consider in a dental practice asset allocation.

contact us Work with Us

Things to consider in a dental practice asset allocation.

contact us Work with UsHow the Asset Allocation Works When Buying a Dental Practice

One area where significant dollars can change hands when buying a dental practice is the asset allocation, or tax treatment, of the total purchase price. You don’t need to become a tax expert, but a little knowledge here can go a long way toward coming together with a seller on a deal.

Asset allocation is an accounting term. Asset allocation is a fancy way to say how much value the accountants in the deal are assigning to the different items being purchased.

“But I’m only buying one thing,” you may say, “a dental practice!”

Not true, says the Internal Revenue Service (IRS).

When you buy a pair of shoes in the store you really are only buying one “thing.” It’s a one-for-one exchange. Money for a sweet pair of shoes.

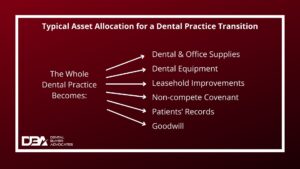

When you buy a business, however, you’re paying for multiple different types of assets. You’re buying supplies, equipment, goodwill, and so on.

The primary reason the asset allocation matters on your (the buyer’s) side is that the IRS allows different depreciation time periods for different asset types.

Depreciation is easy to understand with a quick example. If you buy a new computer for the business, it has a useful life of somewhere around 5 years. Let’s say you pay $1,000 for that computer and plan to use it for 5 years and then buy a new one.

You work, your business makes some money and you use that income to buy the computer. Is the computer a $1,000 expense you can use to offset those profits?

Nope. You’re planning to use that computer for 5 years, remember?

So, the IRS is only going to let you reduce your profit by $200 per year. But that’s $200 per year for each of the next five years.

The same principle applies to any asset you purchase as a business owner that has a value of more than $600 and a useful life of more than a year.

Depreciation is the rule that allocates value to a tangible asset over its useful life. It’s an attempt by the IRS to match the expense of an item to the revenue the asset helps you earn.

Typically, the depreciation rules break the assets of a dental practice into the three main buckets seen in the images below.

How does this affect the seller? The seller doesn’t care about depreciation, so why not try and just load everything into the categories most helpful to you as the buyer? Let’s stick everything in Dental and Office Supplies and Dental Equipment!

Not so fast.

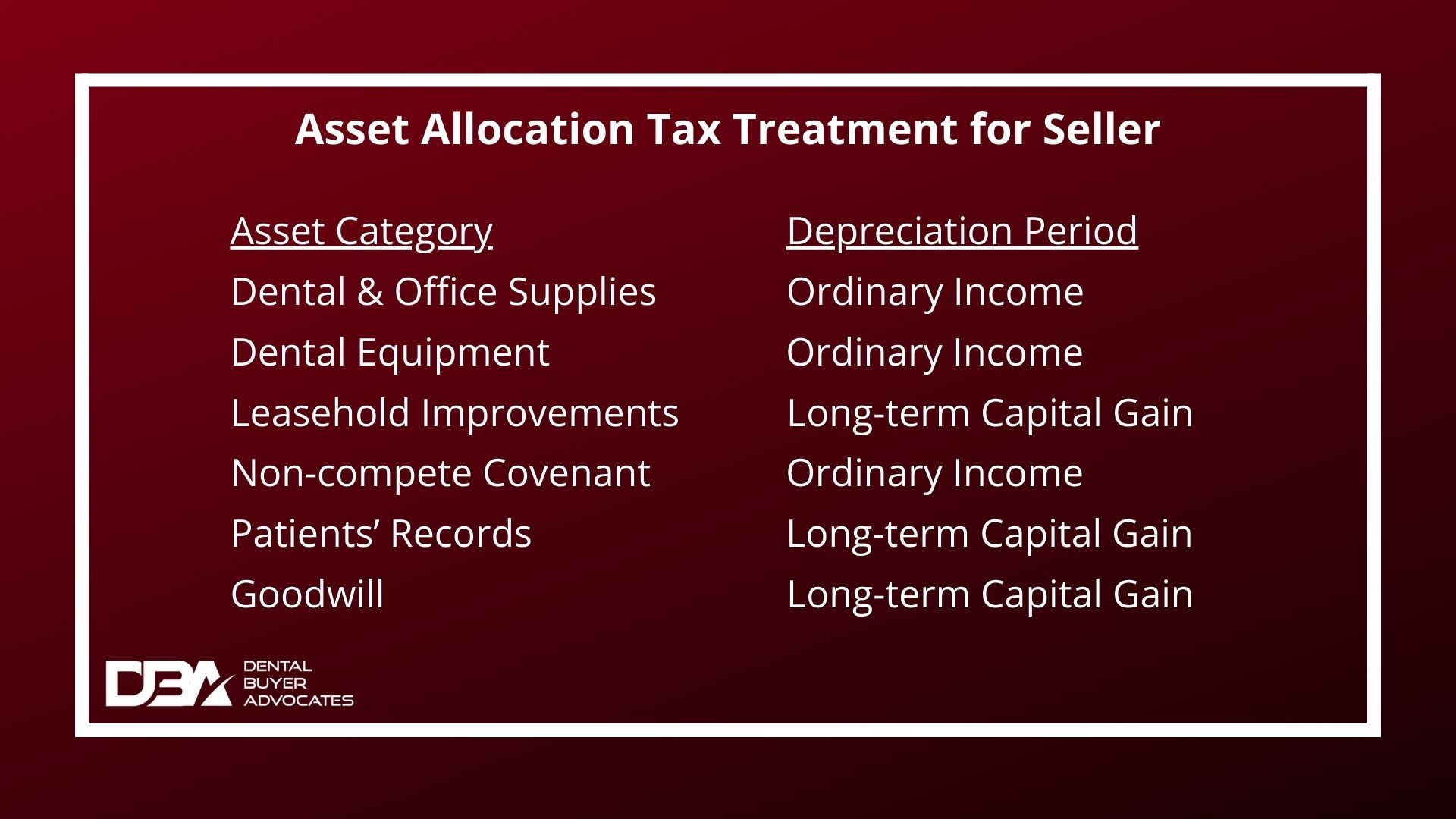

On the other side of the transaction, the IRS has different rules for the seller for the tax treatment of different assets sold.

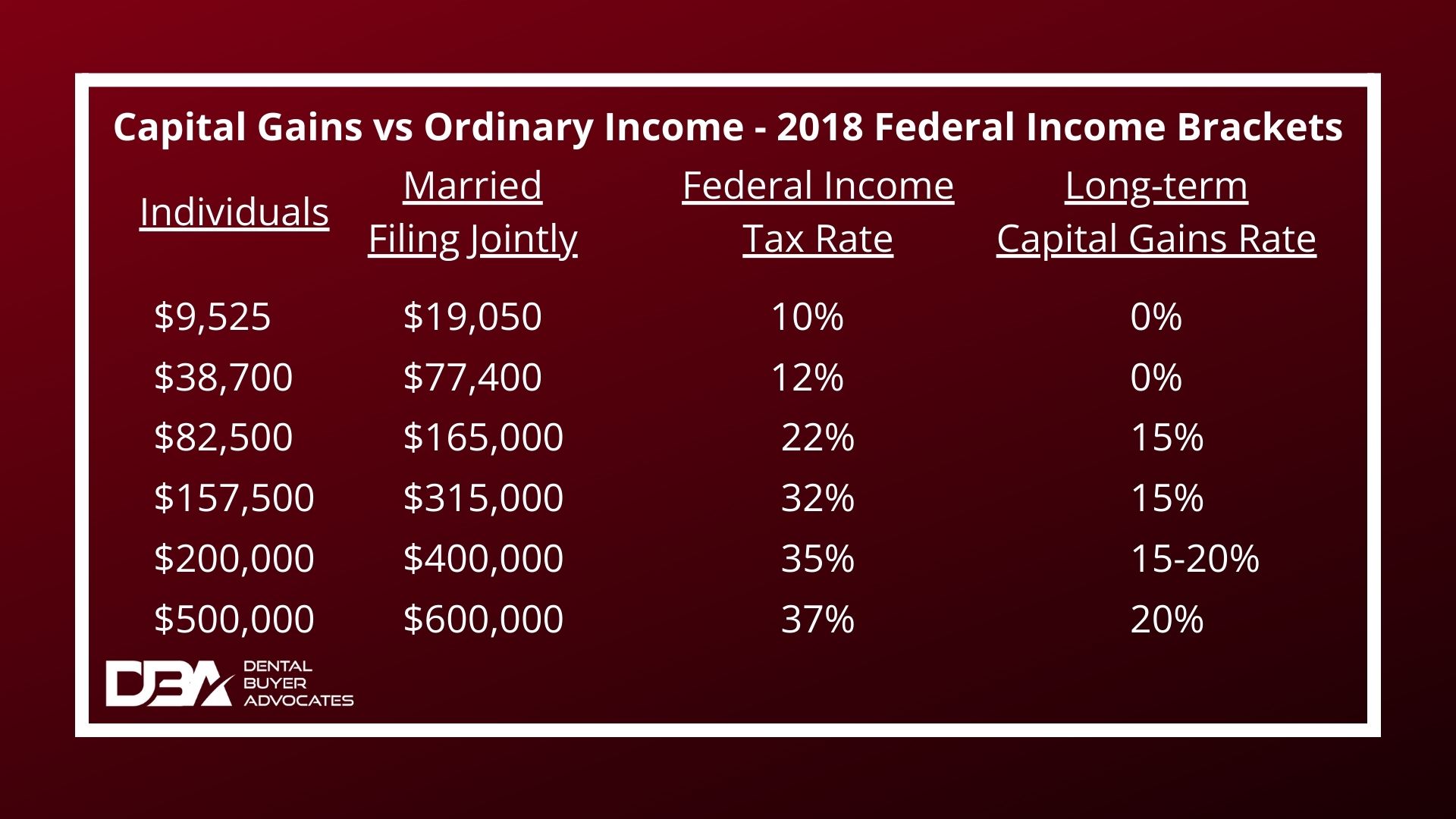

The IRS has two ways to tax sales of assets where the seller makes money: ordinary income and long-term capital gains. Let’s look at ordinary income first. This is the type of tax most people are familiar with. The ordinary income tax rates start at 10% and go up to a whopping 39.6%!

The second way the IRS taxes gains on asset sales is called capital gains. The basic theory behind capital gains is the IRS wants to reward people who invested in resources productive for society, like a business, with a lower overall tax rate on any gains from those investments.

The difference between the two is substantial, anywhere from 0% for low-income taxpayers to 20% for those in the top tax bracket.

If you are a seller, the obvious takeaway from this difference is that you want as much of your income to fall in an asset category where the IRS will tax it as capital gains, and not ordinary income. Doing this could save you as much as 20% on whatever money you can move from an ordinary income category to a capital gains category. The potential savings if you are the buyer are huge!

An important point to consider is that the buyer and seller are required to be consistent in how they treat the values in the different categories. You and the seller are both required to report these numbers to the IRS independently on your next year’s tax return. While the numbers must match, the actual amounts allocated to the different assets is negotiable.

What are the rules? What does the law say? Per the IRS, the technical way to allocate the purchase price among the different assets is to allocate the Fair Market Value to the identifiable assets (patient records, equipment, supplies, etc.), then the remainder, if any, is allocated to Goodwill.

Many buyers assume the values assigned to the different categories are predetermined and set in stone. However, the definition of “Fair Market Value” is the price an independent buyer and seller can agree upon. So basically, if you and the seller agree on the price allocated to the assets, that price is correct.

Back to the point. As the buyer, you’re looking for opportunities to negotiate with the seller on more than just the asking price. Ideally, there are lots of different areas where your interests overlap or at least aren’t directly opposed to one another. We now have three categories with significant dollars behind them where the buyer and seller can move levers to find the option that works best for everyone and leaves everyone happy: price, accounts receivable, and asset allocation.

For example, Dr. Seller could feel very strongly she wants a full-price offer on the practice she’s worked hard to build over the last 25 years. Dr. Seller is going to be on the golf course a lot with her dentist friends and wants to be able to say she got a full price offer for her practice.

Dr. Buyer could ask if she would be willing come down in the percentage of the sale in the goodwill category and increase the amount allocated to equipment to allow her to depreciate the total cost of the sale more quickly.

Alternatively, Dr. Seller might be very sensitive about the large tax bill coming when he sells his practice. “No problem,” says Dr. Buyer, “if you can come down in price a bit, I would be willing to increase the asset allocation of goodwill to allow you to have more of the sale taxed as long-term capital gains.”

I’ve seen this happen frequently. Everyone walks away feeling like their needs are addressed and ultimately more satisfied with the deal.

—————————————————————

I created a guide called “77 Questions to Ask to Avoid Buying the Wrong Dental Practice.”

Get the guide here for free (all I ask is a quick share in return).

—————————————————————

Share the article with a friend. They can use this link to sign up to get awesome articles like this every week.

—————————————————————

Read more below about how to buy a dental practice because good advice is important!

3 Reasons to Choose a Flat Fee Attorney When Buying a Dental Practice

Insurance Credentialing When Buying a Dental Practice

5 Things You Need to Have to Be Ready to Own a Dental Practice

Listen to this podcast episode to understand how and when to complete your due diligence.