It was fun to see an article that I co-wrote be featured in the Dental Economics magazine. Hat tip to my buddy Tripp Yates for allowing me to contribute.

Many believe that the rising cost of student loans is single-handedly responsible for the rise in the number of employee dentists. With the average graduate starting their career with $300,000 in student loan debt, it’s understandable that new dental grads feel overwhelmed and put off practice ownership. Many graduates are looking for guaranteed income to give them peace of mind in paying off their loans. A guaranteed minimum salary sounds and feels safe with no obvious risk, but it can limit cash flow long-term in order to pay off student loans.

For most, it is wise to work as an associate the first year or two out of school for learning, experience and mentorship. This also allows time to gain confidence while working to improve clinical skills and speed. After that, the fastest way for a dentist to pay off student loans is to own a good dental practice.

Don’t agree? Think that practice ownership as a career is getting riskier because student loan balances are going up?

You’re wrong.

Want proof?

If the cost of student loans were changing the risk profile of practice ownership, you’d see fewer banks lending to dentists and lending standards tighten. Instead, we’re seeing more banks than ever competing for loans. Not only are banks still lending 100% of most purchase prices plus working capital, but many banks are also increasing the total amount relative to collections they’re willing to lend. As long as the purchasing dentist has a good credit score and some experience, banks will most likely be eager to provide a loan to purchase a practice.

Sure, it feels riskier with student loan balances going up. But banks don’t deal in feelings. They’ve run the numbers, and know practice ownership is still profitable. They know dentists are the safest small business loan on the planet.

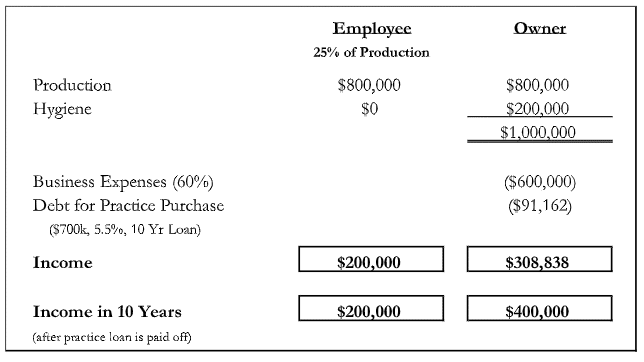

Want to pay off those student loans? The quickest way to do that is to have more money. And the quickest path to more money is practice ownership. Check out how the numbers compare:

For an employee dentist that has $800,000 in annual production, buying a million-dollar dental practice can increase income over $100,000. This assumes the employee dentist is receiving 25% of production in income. The annual debt service on buying the practice is $91,162 for 10 years. After the practice loan is paid off, income increases by $200,000 versus the employee. We assume in this case that the practice purchase price is 70% of collections and 100% financing.

Extra cash flow allows the opportunity for more than just paying off student loans. It’s wise to have an ultimate goal to save 20% of income for retirement. As the business owner, a dentist can set up a retirement plan for the practice. This will allow the owner to save for retirement, reduce current taxes and provide benefits for employees.

As an employee, there are only a certain number of hours in a workday. As a practice owner, there is no limit to how much you can earn. If you reach capacity, you can leverage others with more hygienists, or an associate dentist (the ones scared by their student loan balance…not you!) to continue to grow your business. Ownership also provides you with a very valuable asset that you can sell at your retirement. The average general dental practice sells for 70+% of collections.

Don’t let the burden of your student loans be the reason that you don’t buy a practice. In fact, being a business owner could very well be the sword that helps you slay your student loans quickly. In the same way, it can help you catch up on your retirement savings and increase the lifestyle for your family. It is not the easy way, but it just might be the best way.

—————————————————————

I created a guide called “77 Questions to Ask to Avoid Buying the Wrong Dental Practice.”

Get the guide here for free (all I ask is a quick share in return).

—————————————————————

Read more below about how to buy a dental practice because good advice is important!

The Quick Way to Analyze a Dental Practice For Sale

Four Common Dental Practice Transition Mistakes and How to Avoid Them

4 Things Your Attorney Should Do for You When Buying a Dental Practice