DELUXE PLAN

Our $14,000 plan will set you up for success with full analysis and valuation for unlimited practices, unlimited consulting time with our team, and $3,000 of free tax/bookkeeping services.

Our $14,000 plan will set you up for success with full analysis and valuation for unlimited practices, unlimited consulting time with our team, and $3,000 of free tax/bookkeeping services.

DELUXE PLAN

Total price for any plan is paid half up front and half upon completion.

This is the most important career decision you’ll make as a dentist. We’ll help you get it right.

MEET Your Phase 1 Team

Within 5 business days of sending us documents, you’ll get a ~30 page report to help you answer three big questions: Is this a good practice to buy? If yes, what is a fair price to pay? If I pay that much, how much money will I make?

We’ll do a full valuation from the BUYER’S perspective along with the price we think the target practice is worth.

We’ll verify the financial information of a practice and check the reported numbers against standards ensuring reported numbers are accurate.

We’ll estimate how much money you’ll make as the owner (or partner) of the target practice, including a sensitivity analysis showing how income might be affected by more or fewer patients.

We’ll write the LOI for you and educate you on why certain sections are important. This can save you $1,000-2,000 on attorney fees.

If helpful, we can submit the LOI to the seller or broker on your behalf, or coach you through the most effective way to do that on your own.

We’ll handle any back-and-forth around any important terms in the LOI to ensure you get the right asking price and other terms that can save you potentially tens of thousands of dollars!

Working with the right banker is as important — often more important — than the bank itself. A great banker will help you get the best rate and lowest fees for your loan. At DBA, we work with the top bankers at every major dental lender, and we can introduce you to them, helping you get the best deal possible.

We recommend a flat-rate, dental-only, transitions-focused attorney work on your deal. We know all the dental attorneys in the country and who to recommend (as well as who to avoid). We’ll happily introduce you to the right person for your area.

The second phase involves securing bank financing, completing due diligence, and finalizing legal documents.

We’ll dive deep into the target practice and ensure we thoroughly understand what you are purchasing. Good due diligence includes a thorough review of both reports and in-person due diligence. See helpful tools and resources for this step here.

What due diligence includesThe letter announcing you to patients as the new doctor is your first advertising piece. Do it right. We have concrete good/bad examples to show you exactly how to retain your patients best.

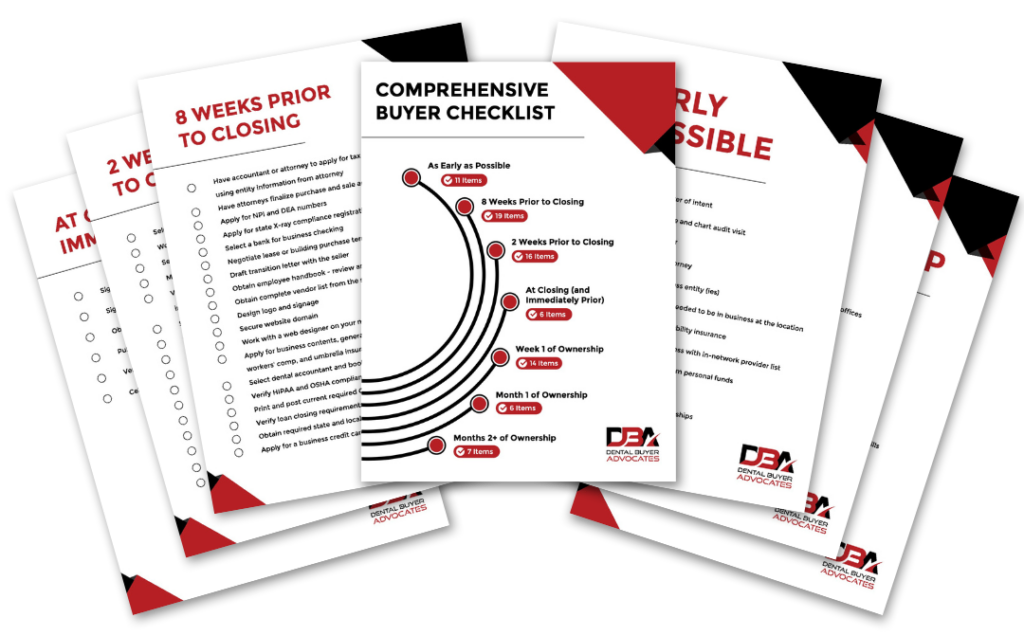

Use our 108-point checklist to get ready to own your business. Some steps are crucial to start as soon as is practical. Others can wait a bit. We’ll work together to make your first days as owner focused more on patients and staff instead of stressing about ownership details.

Most sellers don’t have an employee manual to cover the basics of business like vacation policies and when to ask for a raise. We’ve got a 44-page starter document for you to tweak to fit your situation.

When you become a DBA client, you get personalized advice on how to get the very best dental loan. Last year our average client saved $18,345 just on bank loan negotiations.

We know who the best bankers are at the top banks (the right banker often matters more than the bank) and we know exactly when to call them. We know who can cut their rate a bit. We know which bank is waiving fees this month and why.

We’ll coach you through the process of visiting the pracitce in person and knowing how and what to look for – from equipment, to patient charts, staff and more. We’ll provide personalized coaching, checklists and even click-by-click instructions on how to pull certain reports you need to review. Then, we’ll help you interpret the results of what you saw during your visit.

The lawyer you work with, as well as anyone else you need on your team will be crucial to ensuring your deal moves forward smoothly and with YOUR interests protected. We know and work with the best names in the country on a daily basis. You’ll get the benefit of being a “DBA client” when working with these folks ensuring you get the best pricing and service throughout the process.

Our engagement is always flat-fee, regardless of the time it takes to close on your practice.

The first half of your payment is due upfront. The remaining second half is billed to your business after:

Most dentists engage us when they have a practice in mind to analyze. But you can reach out to us before that process, or anytime you need a second set of eyes to validate the numbers and your decision.

Yes! About 35% of our clients are working on buying into a partnership. If anything, partnership buy-ins are MORE complicated (and we should probably charge more for them) so we strongly recommend getting our help.

Nope. Between us and an attorney, you should be good to go. We act as the accountant throughout the transition and will help you transition to a full-time CPA to help with your taxes and bookkeeping once you become an owner.

We have researched hundreds of practices in all 50 states and fortunately have been able to help clients all over the U.S. without needing to be physically present.

Have questions? Use the calendar or click below to schedule a quick, no-obligation phone call.

Schedule an Intro CallReady to get started? Sign up as a client now and get an engagement letter and payment link sent to you.