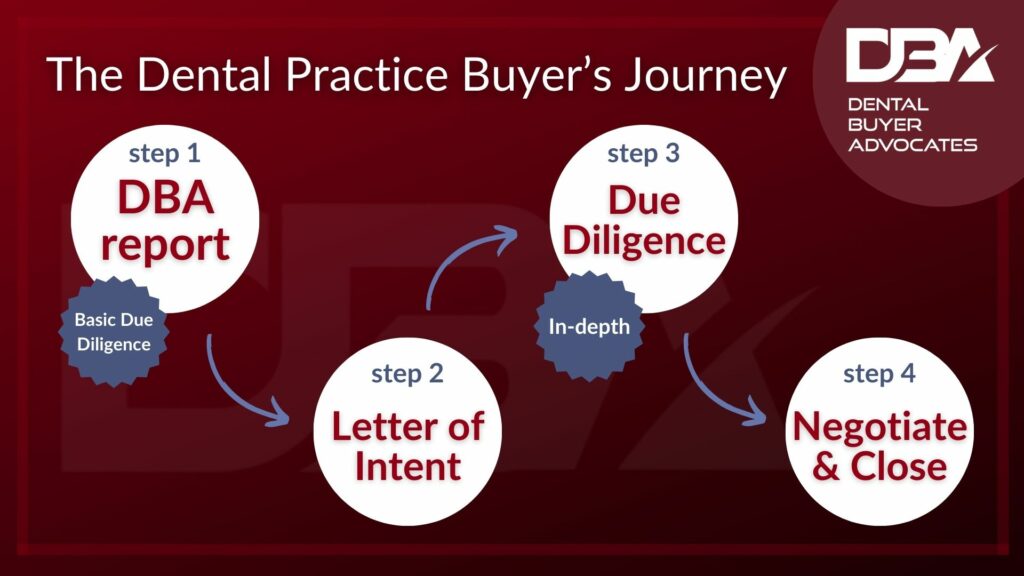

“Am I buying what I think I’m buying?” If you’re going to spend hundreds of thousands, maybe even millions of dollars buying a dental practice, you should be sure you’re getting the dream office that was advertised to you, and not what used car dealers call a “lemon.”

That’s where Initial Due Diligence comes in.

Before the LOI

Before submitting a Letter of Intent, or LOI, to purchase the practice, a buyer will typically receive some financial data including tax returns, Profit and Loss Statements, and perhaps Procedure Production Reports that give basic answers to basic questions:

- What type of practice is this?

- Does this practice fit my vision of one I’d like to own?

- Do the numbers look good enough to pursue a purchase?

During this step of Initial Due Diligence, you will review both quantitative and qualitative factors. These key factors can be analyzed in depth with a practice purchase analysis that our expert team at Dental Buyer Advocates performs. Do the collections, profit, employee expenses, lab fees, dental supply costs, rent, hours of operation, and cash flow all show that this is a good practice to buy? The answers here determine whether or not you’ll move forward with an offer to buy the practice.

However, no matter how detailed, a broker or practice owner doesn’t provide all of the critical data necessary to make an informed purchase decision at first glance. Once you and your attorney submit an offer (and it’s accepted) the process of Deep Dive due diligence is an important next step.

After the LOI

Once the Letter of Intent (a non-binding offer) is signed, two types of deep-dive due diligence are performed: Financial Due Diligence and Practice Due Diligence. Financial Due Diligence is typically initiated and carried out by the bank giving you your practice loan. It involves the bank matching tax returns submitted to IRS, matching paystubs to W2s, examining patient credit reports by the software system, and completing background checks, LexisNexis searches, UCC searches, license searches, and a good old-fashioned search of the seller name on Google.

With Financial Due Diligence, the bank (and your accountant, that’s us) investigate what you’re paying for, digging into questions that couldn’t be answered in the initial analysis. But finances are only part of it.

The Practice Due Diligence is typically done on site at the practice and is carried out by you, with our help. It is best to have two full days in the practice, when possible. While the financial side is telling its own story, you’re doing the same with other aspects of the practice. The story we uncover together should definitively answer the question: Is this the type of practice I truly want to buy?

To do so, a chart audit is necessary. Physically going through, at minimum, 30-50 charts will give you tons of information: What types of patients does the practice see? What procedures are done? Is there work that still needs to be completed in treatment plans? Does the treatment philosophy of the practice match your own?

Reading through so many charts is time consuming. It’s also absolutely necessary before completing a purchase.

It’s often helpful to have a different set of eyes on the practice by hiring a consultant or equipment rep to help answer other questions as well:

- Is the equipment right handed or left handed, and is it in good shape?

- How far out is the schedule booked, for both the doctor and hygienists? Can the practice accommodate emergencies?

- Are the interior and exterior of the practice in good shape?

- How many new patients are coming in, and how do they find the practice? What type of marketing is being done?

- Do they have an employee handbook? Is it any good?

- Are the staff people you’ll want to work with?

By completing these steps in the Deep Dive Due Diligence phase, you’ll have the information and confidence to move forward with purchasing the practice that is truly right for you. If you think you’ve found that potential practice, drop us a line, we’ll help you check it out.